The strategic trajectory of the Chicago Blackhawks between the 2024-25 and 2025-26 seasons serves as a comprehensive case study in the complexities of an NHL rebuilding process. By analyzing the 57-game marker as a comparative yardstick, a clear narrative emerges: a team transitioning from a fragile, veteran-dependent squad into a more resilient, system-driven unit defined by youthful integration and defensive stabilization.

While the offensive output remained remarkably stagnant at an identical 151 goals across both seasonal snapshots, the underlying metrics regarding shot suppression, goaltending consistency, and special teams efficiency reveal a fundamental shift in the organization’s competitive identity. This report provides an exhaustive examination of these variables, utilizing primary statistical evidence and secondary tactical observations to evaluate the efficacy of the franchise’s current direction.

Macro-Level Performance Metrics and Standings Analysis

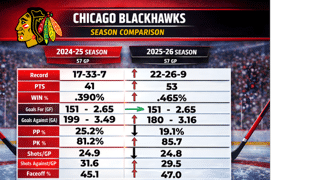

The primary indicator of progress between the two seasons is the 12-point increase in the standings through the first 57 games. During the 2024-25 campaign, the Blackhawks languished with a record of 17-33-7, yielding 41 points and a.390 winning percentage. This performance was indicative of a roster struggling to maintain leads and suffering from prolonged losing streaks, most notably a disastrous December 2024 that ultimately precipitated a coaching change.

By contrast, the 2025-26 season has demonstrated a significant uptick in win density. Through 57 games, the record improved to 22-26-9 for 53 points and a.465 winning percentage. This shift reflects a team that has moved from the absolute basement of the league to a more competitive middle-tier status within the Central Division, rising from 8th to 6th place.

Seasonal Snapshot: 57-Game Comparison Table

| 2024-25 Season (57 GP) | 2025-26 Season (57 GP) | Variance | |

| Record | 17-33-7 | 22-26-9 | +5 Wins |

| Points | 41 | 53 | +12 Points |

| Win % | 0.390 | 0.465 | 0.075 |

| Goals For (GF) | 151 | 151 | 0 |

| GF/GP | 2.65 | 2.65 | 0 |

| Goals Against (GA) | 199 | 180 | -19 |

| GA/GP | 3.49 | 3.16 | -0.33 |

| Power Play % | 25.2% | 19.1% | -6.1% |

| Penalty Kill % | 81.2% | 85.7% | 4.5% |

| Shots/GP | 24.9 | 24.8 | -0.1 |

| Shots Against/GP | 31.6 | 29.5 | -2.1 |

| Faceoff % | 45.1% | 47.0% | 1.9% |

The statistical evidence suggests that while the team has not yet unlocked a higher offensive ceiling, they have significantly raised their defensive floor. The reduction in goals against per game from 3.49 to 3.16 represents a critical threshold for a rebuilding team; it transforms the Blackhawks from an opponent that was frequently “outclassed” into one that is “consistently in games”.

Game State Management and the “Meaningful Game” Metric

While the standings jump is significant, a deeper look at game state management reveals the fragile nature of this progress. The 2025-26 Blackhawks are playing “meaningful games” far more frequently, with 25 of their 57 contests decided by a single goal. In these high-leverage situations, the team has posted a record of 9-7-9, a notable shift from the league-worst 7-9-11 mark in close games during 2024-25.

However, fundamental flaws persist. The team is still consistently outshot in every period, reflecting ongoing puck possession struggles. They are particularly vulnerable during the second period, carrying a -13 goal differential in that frame alone. Most critically, the roster lacks “comeback” resilience; they have secured only 3 wins in 24 games when the opponent scores first, and just 2 wins in 22 games when trailing after 40 minutes. These metrics suggest that while the team is more competitive, they remain largely unable to dictate the pace once falling behind.

The Offensive Paradox: Scoring Consistency Amidst Systemic Change

One of the most intriguing findings in the comparative analysis is the absolute parity in total goals scored. Scoring exactly 151 goals through 57 games in consecutive seasons suggests a persistent ceiling in the team’s offensive firepower. However, the mechanism of these goals has evolved. In 2024-25, the offense was heavily reliant on high-percentage shooting from a limited number of players, most notably Ryan Donato, who enjoyed a career-best 31-goal season buoyed by a 17% shooting rate that analysts deemed unsustainable.

In the 2025-26 season, the offensive workload has been redistributed. While Donato’s production normalized downward as predicted, the emergence of Frank Nazar and the continued dominance of Connor Bedard provided a more diversified attack. Bedard’s third professional campaign has been defined by increased shooting volume and a higher individual shooting percentage of 16.1%, allowing him to maintain elite production despite a more rigorous defensive focus from opponents

Individual Scoring Analysis (2025-26 Snapshot)

| Player | Position | GP | G | A | PTS | S% | TOI/G |

| Connor Bedard | C | 44 | 23 | 30 | 53 | 16.1% | 20:58 |

| Tyler Bertuzzi | LW | 54 | 25 | 17 | 42 | 21.0% | 18:25 |

| Andre Burakovsky | LW | 51 | 10 | 20 | 30 | 14.5% | 17:04 |

| Ryan Donato | C | 57 | 13 | 12 | 25 | 14.9% | 15:00 |

| Frank Nazar | C | 41 | 7 | 17 | 24 | 7.9% | 18:30 |

| Teuvo Teravainen | C | 50 | 10 | 13 | 23 | 16.7% | 18:06 |

| Ilya Mikheyev | RW | 52 | 11 | 12 | 23 | 13.1% | 17:41 |

The stagnation in overall offensive growth (remaining at 2.65 GF/GP) underscores a critical need for the bottom six to provide more support when the top six is producing. Currently, the bottom-six forwards—anchored by veterans Nick Foligno and Jason Dickinson alongside prospects like Oliver Moore, Colton Dach, and Landon Slaggert—lack the elite skill and offensive depth required to drive play, resulting in a meager output of only 30 goals this season. These units have focused primarily on defensive responsibilities and penalty killing, often at the expense of offensive zone time. While this tactical prioritization is a hallmark of Jeff Blashill’s coaching philosophy, which emphasizes that ‘offense starts with good defense,’ the lack of secondary scoring remains a clear hurdle for the team’s competitive evolution

Defensive Structural Overhaul: Shot Suppression and Goal Prevention

The most dramatic improvement in the Blackhawks’ profile is the reduction in goals against. Moving from 199 goals allowed to 180 over a 57-game span represents a significant systemic win. This improvement is the result of a deliberate shift in defensive philosophy following the dismissal of Luke Richardson in December 2024. Richardson’s system focused on a 1-2-2 zone structure designed to clog the middle, but it often resulted in the team being pinned in their own zone for extended periods, leading to an NHL-worst shot differential.

Under Jeff Blashill, the Blackhawks transitioned to a “hybrid” pressure system. This approach utilizes the team’s skating speed and the reach of their unusually tall defensive corps—headlined by the 6’6″ Alex Vlasic and 6’8″ Louis Crevier—to engage opponents earlier in the neutral zone and force turnovers. The reduction in shots against per game from 31.6 to 29.5 is a direct consequence of this more aggressive posture.

Defensive Workload and Suppression Metrics (2025-26)

| Defender | Age | GP | Blocks | Hits | TOI/G | +/- |

| Alex Vlasic | 24 | 56 | 82 | 41 | 20:59 | -13 |

| Artyom Levshunov | 19 | 52 | 64 | 38 | 19:11 | -27 |

| Wyatt Kaiser | 23 | 57 | 71 | 55 | 19:10 | -12 |

| Connor Murphy | 32 | 57 | 95 | 110 | 16:30 | -5 |

| Louis Crevier | 24 | 54 | 58 | 45 | 16:19 | -1 |

| Matt Grzelcyk | 31 | 57 | 42 | 15 | 17:01 | -3 |

The emergence of Alex Vlasic as a legitimate top-pairing shutdown defender has been the anchor of this transformation. Despite his young age, Vlasic has assumed the most difficult defensive assignments, allowing the organization to trade veteran Seth Jones in the 2025 offseason. While the plus-minus ratings for the younger defenders, such as Levshunov, remain negative, this is largely reflective of their high-usage roles in developmental scenarios where mistakes are expected as part of the learning curve.

Special Teams: The Divergent Trajectories of the PP and PK

A central theme in the review of the 2025-26 season is the radical divergence in special teams performance. In 2024-25, the power play was a relative strength, operating at 25.2% through 57 games. This unit benefited from the veteran puck-moving abilities of Seth Jones and a high-efficiency net-front presence by Ryan Donato. However, the loss of Jones as the “power play quarterback” and the normalization of Donato’s shooting luck led to a significant regression in 2025-26, with the unit falling to 19.1%.

The struggle of the power play is compounded by inconsistency at the quarterback position. Rookie Sam Rinzel began the season as the primary point man but was later demoted to Rockford for further development. Artyom Levshunov took over those responsibilities until late January, when Rinzel was recalled and Levshunov was moved to the healthy scratch list. While Connor Bedard and Tyler Bertuzzi have remained productive—combining for 15 power-play goals—the unit’s chemistry is often lacking. The absence of an elite, game-breaking quarterback like Cale Makar or Quinn Hughes has made the man-advantage significantly more complicated than it was under the veteran direction of Seth Jones last season.

Conversely, the penalty kill has undergone an elite transformation, surging from 81.2% to 85.7%. This improvement has catapulted the Blackhawks into the league’s top tier for shorthanded defense. Blashill’s “aggressive PK” philosophy encourages forwards like Mikheyev and Teravainen to pressure the points, leading to a significant increase in short-handed offensive opportunities. By February 2026, the Blackhawks were projected to finish in the top five in short-handed goals, turning a traditionally defensive situation into a viable scoring weapon.

Special Teams Efficiency Comparison Table

| 2024-25 (%) | 2025-26 (%) | League Rank (25-26) | |

| Power Play | 25.2 | 19.1 | 21st |

| Penalty Kill | 81.2 | 85.7 | 1st |

This “special teams paradox” highlights the growing pains of a young roster. The team has learned how to effectively “deny” opponents but has simultaneously lost the veteran poise required to “exploit” man-advantage situations. The long-term outlook remains positive, as the high-end skill of the prospects is expected to eventually synchronize, restoring the power play to its 2024-25 levels while maintaining the new defensive standard.

Goaltending and the Seth Jones Strategic Pivot

The decision to trade Seth Jones to the Florida Panthers in exchange for Spencer Knight was the defining transaction of the 2025 offseason. Jones had been the team’s workhorse, leading in ice time and serving as an alternate captain, but his contract and age profile did not align with the team’s competitive window. In Knight, the Blackhawks acquired a 24-year-old former top prospect with the potential to be a franchise cornerstone.

The statistical impact of this trade has been profound. While the defense became younger and less experienced, the goaltending became more consistent. Spencer Knight has stabilized a position that was a revolving door of aging veterans and struggling prospects in previous years.

Goaltending Statistical Breakdown (2025-26)

| Goaltender | GP | W | L | OTL | GAA | SV% | SO |

| Spencer Knight | 39 | 16 | 16 | 7 | 2.62 | 0.910 | 3 |

| Arvid Soderblom | 17 | 5 | 7 | 1 | 3.87 | 0.873 | 1 |

| Drew Commesso | 2 | 0 | 0 | 0 | 3.36 | 0.880 | 0 |

Knight’s.910 save percentage through 39 games is a significant upgrade over the.885 team average recorded in 2024-25. His ability to make “saves he shouldn’t” has provided a safety net for a young defensive corps that still frequently surrenders high-danger chances due to positioning errors. The trade effectively prioritized “run suppression” at the source (the net) over “shot suppression” at the point (Jones), a gamble that the 19-goal reduction in GA suggests has paid off.

Possession, Faceoffs, and Center-Ice Development

A perennial weakness for the Blackhawks during the initial years of the rebuild was their inability to control the puck from the center-ice dot. In 2024-25, the team won just 45.1% of their faceoffs, a metric that analysts used to explain their consistently low puck possession time. Connor Bedard, while brilliant offensively, struggled physically in the circle, winning only 38.3% of his draws in 2024-25.

The 2025-26 season has seen a deliberate focus on this area. Bedard’s physical maturation and technical adjustments have led to a significant jump in his win rate to 47.0%. Additionally, the full-time arrival of Frank Nazar and the emergence of Ryan Greene as a reliable defensive center have bolstered the unit.

Faceoff Efficiency and Positional Roles (2025-26)

| Player | Position | Faceoffs Taken | FO Wins | FO% |

| Jason Dickinson | C | 638 | 316 | 49.5% |

| Ryan Greene | C | 626 | 285 | 45.5% |

| Frank Nazar | C | 532 | 240 | 45.1% |

| Connor Bedard | C | 315 | 148 | 47.0% |

| Nick Foligno | LW | 203 | 148 | 48.8% |

| Ryan Donato | C | 206 | 103 | 50.0% |

The collective improvement to 47.0% represents a crucial step in the team’s evolution. Higher faceoff win rates lead to fewer “chase” scenarios, particularly in the defensive zone, which correlates with the team’s overall reduction in shots against. This trend is a primary indicator of the “center-ice maturity” that general manager Kyle Davidson has cited as a prerequisite for the team to move out of the rebuild phase and into a competitive one.

Tactical Evolution: The Transition from Richardson to Blashill

The most significant qualitative factor in the Blackhawks’ year-over-year improvement is the coaching shift. The mid-2024-25 firing of Luke Richardson and the subsequent hire of Jeff Blashill in May 2025 signaled a transition in the organization’s developmental philosophy. Richardson was valued for establishing a “culture of accountability” during the teardown phase, but his rigid 1-2-2 system was often criticized for stifling the creativity of elite offensive prospects like Bedard.

Jeff Blashill has implemented a more fluid “hybrid” system that prioritizes skating and conditioning. This 2-1-2 forecheck is designed to create turnovers through pressure rather than clogging passing lanes. This shift has made the Blackhawks a “faster” team to watch, if not necessarily a more productive one in terms of goals scored.

Systemic Philosophies: A Comparative Summary

| Richardson’s System (2024-25) | Blashill’s System (2025-26) | Competitive Impact | |

| Forecheck | 1-2-2 (Passive) | 2-1-2 (Aggressive) | More turnovers forced in neutral zone |

| D-Zone | Zone / clog-the-middle | Hybrid pressure / man-on-man | Lower GA; higher high-danger risk |

| Breakouts | Controlled / slow | Attack off the rush | Faster transition; higher shot-volume efficiency |

| Conditioning | Standard NHL | High-intensity / elite | Improved late-period performance |

The “Blashill effect” is most evident in the team’s ability to stay in games against elite opponents. In 2024-25, the Blackhawks were frequently blown out in the second and third periods as their structure collapsed under sustained pressure. In 2025-26, the team’s superior conditioning and aggressive defensive posture have allowed them to remain within one goal in the vast majority of their losses, a “moral victory” that statistically manifests as the 12-point jump in the standings.

Prospect Integration and the Rockford Pipeline

The 2025-26 season marks the first year where the “next wave” of the Blackhawks’ rebuild has taken center stage. The organization’s top-ranked prospect pipeline—featuring Bedard, Nazar, Levshunov, and Rinzel—is now largely integrated into the NHL roster. This has resulted in the Blackhawks becoming one of the youngest teams in the league, with an average age of 26.5 compared to 28.1 in 2024-25.

The role of the AHL affiliate, the Rockford IceHogs, has been critical in managing this transition. The transaction logs from 2025-26 show a constant “shuttle” of prospects—such as Landon Slaggert, Colton Dach, Oliver Moore, Nick Lardis and Sam Rinzel—being moved between the two clubs to manage workloads and development goals. While Frank Nazar and Artyom Levshunov have been mainstay fixtures in the NHL lineup, they have yet to establish a consistent on-ice connection, contributing to the broader struggle to synchronize offensively “. The integration of Rinzel has been even less direct; after beginning the season on the roster, he was reassigned to Rockford to refine his game before being recalled for the current stretch.

The presence of three first-rounders from the 2025 draft—Anton Frondell, Vaclav Nestrasil, and Mason West—further bolsters the organizational depth, although they have remained in development leagues for the 2025-26 campaign. Looking ahead, elite assets like Frondell and KHL standout Roman Kantserov—whose contract expires May 31, 2026—could potentially join the Blackhawks as early as the conclusion of their respective European seasons late this year.

Key Prospect Status and Impact (2025-26)

| Player | Draft Pedigree | Role | Performance Narrative |

| Connor Bedard | 2023 #1 Overall | Franchise C | 1.20 PTS/GP; Developing into a franchise player |

| Artyom Levshunov | 2024 #2 Overall | Top-Pairing D | “Miles ahead” hockey IQ; learning NHL physicality |

| Frank Nazar | 2022 #13 Overall | Top-Six C | “Emerging gem”; critical to secondary scoring |

| Ryan Greene | 2022 #57 Overall | Shutdown C / PK | Reliable defensive anchor; contributing 20 points in 56 games while maintaining elite PK utility |

| Sam Rinzel | 2022 #25 Overall | PP Quarterback / Top 4 Pairing | We need to be patient with him. Potential is there… |

| Oliver Moore | 2023 #19 Overall | Bottom-Six C / Winger | Providing elite speed; focused on defensive maturity |

The comparative analysis reveals three core pillars of progress

Defensive Stabilization: The 0.33 reduction in GA/GP and the elite status of the PK indicate that the team has successfully built a “defensive identity” that was entirely absent in 2024-25.

Goaltending Certainty: The acquisition of Spencer Knight has removed the volatility from the most important position on the ice, providing a foundation for the skaters to play a more aggressive, modern style.

Center-Ice Depth: The maturation of Bedard and the arrival of Nazar and Greene have given the team a spine of centers that can compete physically and technically, as evidenced by the improved faceoff metrics.

The primary area of concern remains the offensive stagnation. Scoring exactly the same number of goals (151) as the previous year suggests that while the “floor” of the team has risen, the “ceiling” remains limited by a lack of elite wing depth beyond Bertuzzi and Teravainen. The next phase of the rebuild will likely focus on utilizing the team’s massive pool of future draft picks to acquire or develop high-end finishers who can capitalize on the transitions created by the new defensive system.

Conclusion

The Chicago Blackhawks’ 2025-26 season represents a pivot point in the rebuilding team. Through 57 games, the team has proven to be a significantly more difficult opponent than in the 2024-25 campaign. The 12-point standings jump is the external manifestation of internal improvements in shot suppression, goaltending consistency, and penalty-kill efficiency.

While the power play has regressed and the overall scoring rate has not yet increased, the successful integration of elite prospects like Nazar, Rinzel, and Levshunov suggests that the organization has successfully built a sustainable foundation. The 2025-26 Blackhawks are no longer a team merely “waiting for the draft”; they are a team learning how to defend, how to compete, and how to win—one goal at a time.